With some option strategies, it’s not clear if the strategy was designed to meet a need or to justify a clever name. That’s the case with the Twisted Sister. The opposite of the equally fanciful Jade Lizard, it is a short strangle plus a long put. It offers modest premium income with relatively little risk in low-volatility bear markets.

Setting up the Twisted Sister

A Twisted Sister consists of one short call, one short put with a lower strike price, and one long put with an even lower strike price. All options are on the same underlying security, have the same expiration date and are out of the money. This is a credit spread, because the revenue from writing the short call and short put exceeds the premium paid to buy the long put.

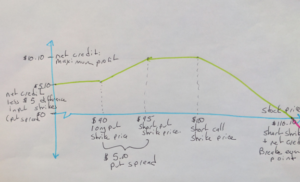

Let’s look at a Twisted Sister setup for a stock that currently trades at $97.50.

| Position | Strike Price | Credit/(Debit) |

| Short call | 100 | $8.95 |

| Short put | 95 | $5.60 |

| Long put | 90 | ($4.45) |

Remember that if you are selling (writing) an option, you receive the bid price, and if you are buying an option, you pay the ask price. The total credit balance for this transaction is $8.95 + $5.60 – $4.45, or $10.10. You keep that amount as long as you are not assigned to exercise any of the options.

Potential Profit and Loss

If the underlying stock stays in a range between $100 and $95, you receive the maximum net credit balance of $10.10. If the underlying goes above or below that range, your payout changes.

If the stock price goes below $95, then the short put goes in the money. If it is assigned to you for exercise, you lose the difference between $95 and the stock price. If the stock goes to $90, however, you can exercise your long put, so the maximum hit on a declining stock price is $5.00. Because you have a net credit of $10.10, this means that on the downside, you will make at least $10.10 – $5.00, or $5.10.

The maximum profit is the $10.10 net credit, which you keep if the stock price stays between $95 and $100. It is not profitable for the option holder to exercise anywhere within this range.

If the stock price hits $100, then the option holder may choose to exercise. If that happens, you will have to buy the shares at the current market price. This will reduce your net credit position until the stock price hits $110.10 (the $100 strike price + the $10.10 net credit.) After that break-even point, your loss is theoretically unlimited.

When to use the Twisted Sister

The Twisted Sister is a bearish strategy because it pays off if the stock price stays flat or falls. It also benefits from low volatility, because the maximum payoff occurs in a narrow range.

Because the maximum payoff of the Twisted Sister is the net credit spread, this strategy only works if the net credit spread is larger than the put spread (different between the strike prices on the long and short puts). Otherwise, the protective put adds no value.

While the Twisted Sister has low risk, it has some risk to the upside. One way to reduce this risk is to choose options on a stock that you already own, turning the position into a covered call. Another way to reduce risk is to pay close attention to upside price movements and close the long call with an offsetting trade as the share price approaches the strike price.

The Twisted Sister’s cousins

The Twisted Sister is related to other options strategies that offer different credit payouts, different risk levels, and in different market conditions.

The short strangle

If you’ve looked at options strategies before, you might have noticed that the Twisted Sister consists of a short strangle (the short put and the short call) and a long put. The protective put makes the position profitable if the price of the security goes down, while a short strangle will lose money if the stock price falls below the strike price (less the value of the credit position). This means that the Twisted Sister has a wider range of profit opportunities than the short strangle.

The iron condor

An iron condor is a Twisted Sister with the addition of a long call with a slightly higher strike price. While this reduces the risk, it also reduces (and may eliminate) the value of the credits from selling the call and the put. This means that you will find fewer profit opportunities.

What about the Jade Lizard?

The Jade Lizard is the reverse of the Twisted Sister. It pays off on the upside and loses money on the downside. To create it, short an out-of-the-money put, short an out-of-the-money call on the same underlying security and same expiration date with a higher strike price, and then buy a call with an even higher strike price.

The Bottom Line

The Twisted Sister is a strategy that works when the market has low volatility and a bearish tilt. Its profit is capped at the net credit on the initial position. You probably won’t find a lot of opportunities to put it to work, but it’s nice to have in your toolbox when the market conditions are favorable.