Recently, I’ve seen several discussions on social media about managing cash flows for freelancers. Here’s what I know:

Recently, I’ve seen several discussions on social media about managing cash flows for freelancers. Here’s what I know:

- Managing your cash flow is key to success in the long run.

- Cash flow is different from income – and ultimately more important.

- Cash flow is tricky to calculate and forecast, as any first-year accounting student or associate analyst will tell you.

- If you can understand the cash flow, you can understand a lot about how a business is doing.

Income tells you how much money comes in and how much money goes out. Cash flow tells you whether the money will come in fast enough to cover your bills.

Over the years, I’ve developed a simple spreadsheet that tells me where my cash flow stands. I set up a version with dummy numbers for you to use, but read on so that you understand what I did and how you might need to change it. Download the basic file here: Freelancer Cash Flow Spreadsheet.

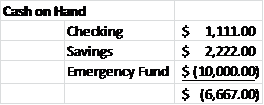

Cash on Hand

The first section is the amount of money on hand. Mine has three lines, one for my checking account balance, one for my savings account balance, and one f or my emergency fund. The savings account is an interest-bearing account where I keep money that I don’t need right away. In theory, it is my emergency fund, which should be about three months’ worth of expenses which runs about $10,000 for me. (This assumes that, in a true emergency, you’ll cut back the extraneous expenses.)

or my emergency fund. The savings account is an interest-bearing account where I keep money that I don’t need right away. In theory, it is my emergency fund, which should be about three months’ worth of expenses which runs about $10,000 for me. (This assumes that, in a true emergency, you’ll cut back the extraneous expenses.)

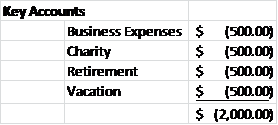

Key Accounts

The next section is called “Key Accounts”, for lack of a bette r title idea. This covers the your business expenses, retirement, and any other priorities you have. For me, that would include charitable contributions and travel. These are reductions from your cash flow. When you book a new project, take some portion of the revenue that you expect to generate and add it here. So, if you were to bring in a new project that paid $1000, you might out 5% of that into each of these accounts. They are uses of money, so they are negative.

r title idea. This covers the your business expenses, retirement, and any other priorities you have. For me, that would include charitable contributions and travel. These are reductions from your cash flow. When you book a new project, take some portion of the revenue that you expect to generate and add it here. So, if you were to bring in a new project that paid $1000, you might out 5% of that into each of these accounts. They are uses of money, so they are negative.

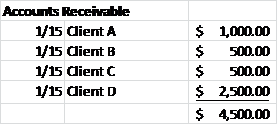

Accounts Receivable

The next section is accounts receivable, or money that people owe you. Enter the date that you  sent the invoice in the first column so that you can track overdue payments. This is money that you will be receiving, but you can’t spend it yet. One freelancer I know says that she’ll retire the day that her receivables are at zero, and it’s a good enough philosophy that I have adopted it.

sent the invoice in the first column so that you can track overdue payments. This is money that you will be receiving, but you can’t spend it yet. One freelancer I know says that she’ll retire the day that her receivables are at zero, and it’s a good enough philosophy that I have adopted it.

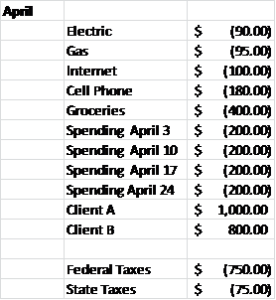

Monthly Budget

The next part of the spreadsheet is your budget for the next tax period. I’ve found that if I budget for the entire year, I have too much anxiety in the early part of the year, but if I budget for only a month, then I get whipsawed at tax time. So, for me, I forecast ahead until at least the nex t month that taxes are due (April, June, September, January); I’ll go out to the next tax period if I have revenue booked.

t month that taxes are due (April, June, September, January); I’ll go out to the next tax period if I have revenue booked.

Each month’s budget includes the bills I have to pay and the things I need to buy (groceries, spending money). This should reflect your life, not mine. Track your spending if you aren’t sure what to enter.

I’ve also included revenue that has been booked but not invoiced. I’ll add it to the month that I expect to receive the money.

Finally, for each tax period, I keep an estimate of how much I expect to pay in taxes. I base it off actual revenue and expenses, like a good MBA, but you may have a different system based on the IRS estimation calculation. Whatever you use, the different tax agencies expect the money to be paid when due, so be sure to include it.

Totals

Once you have the budget set up, you want to use the =SUM formula to find the total amount of money in your budget. The range should be only the monthly budgets. That’s how much money you will be earning.

Then, you want to find the total cash flow. Add up the subtotal of each section: cash on hand, key accounts, accounts receivable, and monthly budget. The grand total is your total cash flow.

Using the Total Cash Flow Calculation

The total cash flow number may very well be negative. It often us, with this system; I have a huge negative number on my actual spreadsheet right now. A negative number is not a sign to panic; it a sign to bring in more revenue.

- If the number is negative, you have to hustle. This is the sign to go out and find more and better work. It is also a sign to watch your spending.

- If the number is positive, you can cut back for a little bit, or you can concentrate on fun and interesting projects that don’t pay particularly well. This is when I’ll work on essays, write guest blog posts, or research ideas that may never turn into real assignments.

Using the Spreasheet

Here are the basics:

- Customize the lines to your needs.

- When you book a new project, add it to the month you expect to receive the revenue, then add a share of that money to your key accounts.

- When you invoice a client, delete the row from your monthly budget and add it to accounts receivable.

- Check the totals cells, as the adding and deleting of rows may throw them off. You may need to re-enter the ranges to get an accurate total.

Finally . . .

There may be easier ways to do this. If you know of any improvements, please let me know in the comments. Now go, and knock ’em dead!